Featured

Table of Contents

The therapist will certainly assess your finances with you to determine if the program is the right choice. The evaluation will consist of a take a look at your monthly income and costs. The agency will certainly pull a credit score report to understand what you owe and the degree of your challenge. If the forgiveness program is the very best remedy, the counselor will certainly send you an agreement that information the plan, consisting of the quantity of the monthly repayment.

Once everybody agrees, you start making regular monthly settlements on a 36-month strategy. When it mores than, the agreed-to amount is gotten rid of. There's no fine for repaying the equilibrium early, however no expansions are enabled. If you miss out on a repayment, the arrangement is nullified, and you need to leave the program. If you think it's a great alternative for you, call a therapist at a not-for-profit credit therapy company like InCharge Financial debt Solutions, who can answer your concerns and help you establish if you certify.

Since the program allows consumers to choose much less than what they owe, the creditors that take part desire confidence that those that capitalize on it would not be able to pay the sum total. Your credit history card accounts also have to be from banks and bank card companies that have actually concurred to participate.

Equilibrium must be at least $1,000.Agreed-the equilibrium should be repaid in 36 months. There are no extensions. If you miss a payment that's just one missed repayment the contract is terminated. Your creditor(s) will certainly cancel the strategy and your balance returns to the original quantity, minus what you have actually paid while in the program.

The Basic Principles Of What Debt Counseling Usually Charge

With the forgiveness program, the creditor can instead select to maintain your financial debt on guides and recover 50%-60% of what they are owed. Nonprofit Bank Card Financial obligation Forgiveness and for-profit financial obligation negotiation are similar because they both offer a method to work out charge card debt by paying much less than what is owed.

Credit card forgiveness is made to set you back the customer less, repay the financial obligation quicker, and have less drawbacks than its for-profit counterpart. Some vital areas of difference in between Bank card Financial debt Forgiveness and for-profit financial debt settlement are: Charge card Financial debt Forgiveness programs have partnerships with financial institutions who have accepted participate.

Once they do, the payoff period begins immediately. For-profit financial debt settlement programs negotiate with each lender, normally over a 2-3-year period, while interest, fees and calls from debt collection agencies proceed. This means a bigger appeal your credit score record and credit rating, and an increasing equilibrium until arrangement is finished.

Credit History Card Debt Forgiveness customers make 36 equivalent month-to-month payments to remove their financial obligation. For-profit financial debt settlement customers pay into an escrow account over a settlement duration toward a lump sum that will be paid to creditors.

7 Easy Facts About Knowing Your Rights Related to Bankruptcy Proceedings Shown

During this moment, fees may increase, and rate of interest accumulates, so payments might wind up not being affordable for customers. Meanwhile, clients stop making settlements to their charge card accounts. Calls from financial obligation enthusiasts proceed and creditor-reported non-payments proceed to damage the client's credit rating report. Registration in a Credit Scores Card Financial debt Forgiveness stops calls and letters from financial obligation collection and recuperation firms for the accounts included in the program.

For-profit financial obligation settlement programs don't quit collection actions until the lump-sum payment is made to the financial institution. Nonprofit Credit Card Financial debt Forgiveness programs will certainly tell you up front what the month-to-month cost is, capped at $75, or less, relying on what state you stay in. For-profit financial obligation negotiation firms may not be clear regarding cost quantities, which typically are a portion of the balance.

The 20-Second Trick For Real Testimonials from People Who Secured Peace of Mind

For-profit financial debt negotiation likely will harm it a lot more, considering that you will not be paying financial institutions throughout the 2-3 year negotiation/escrow duration, but they have not agreed to a plan or received any type of cash, so they're still reporting nonpayment. This gets on top of the credit history struck from not paying the total.

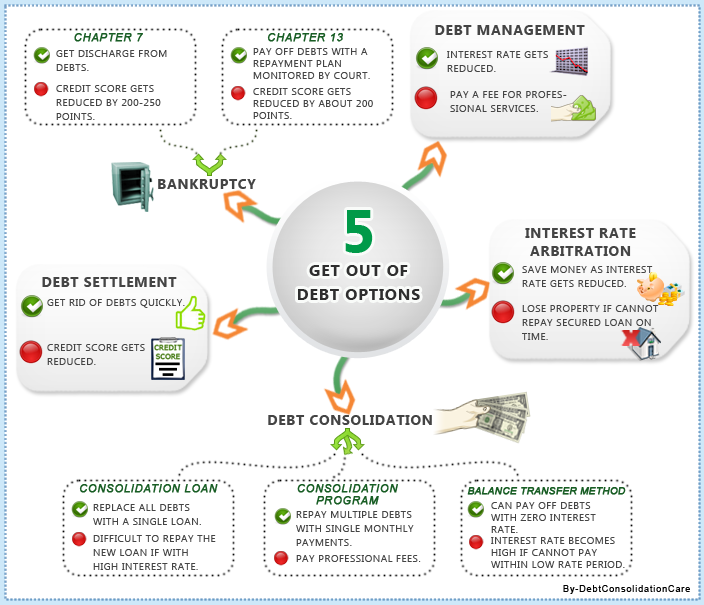

For the most part, debt combination additionally includes a reduced rate of interest than what you were paying on your charge card, making the monthly costs, along with total prices, less. Charge card financial obligation loan consolidation's most usual types are financial debt administration plans, financial obligation loan consolidation car loans, or a zero-interest transfer debt card.

To get a debt loan consolidation lending or a zero-interest balance transfer credit rating card, you require a debt rating of at the very least 680. Debt score isn't an element for debt management program, yet you require an adequate earnings to be able to make a monthly payment that will certainly cover all of the accounts consisted of in the program.

Personal bankruptcy is the last hotel for someone who has even more debt than they can pay. It can be the step you take in order to prevent insolvency.

What Does Actual Stories from Credit Counseling Services : APFSC Help for Debt Management Recipients Do?

Bankruptcy will eliminate all qualified unprotected debt. Bank Card Financial debt Forgiveness will certainly have an adverse effect on your credit history because complete balances on accounts were not paid. However once you've completed the program, the accounts will certainly reveal a no balance, not that you still owe cash. Insolvency will certainly have a far more severe adverse influence on your credit record, making it tough to obtain a home loan, auto loan, or other required credit score in the years that adhere to.

Bank Card Debt Forgiveness repayments begin as quickly as you're approved right into the program. Insolvency authorization and discharge can take 6-12 months. Collection actions and suits on Credit scores Card Financial debt Forgiveness clients are stopped when lenders concur to the plan. Filing for bankruptcy causes an automatic remain on collection actions and suits, and offers protection from harassment by lenders, but if the court does not authorize the insolvency, those will certainly launch again.

Table of Contents

Latest Posts

Not known Facts About Regulatory Aspects in Bankruptcy Proceedings

Some Known Details About Chapter 13 Fundamentals Before You Decide

How State Initiatives That Offer Debt Relief can Save You Time, Stress, and Money.

More

Latest Posts

Not known Facts About Regulatory Aspects in Bankruptcy Proceedings

Some Known Details About Chapter 13 Fundamentals Before You Decide

How State Initiatives That Offer Debt Relief can Save You Time, Stress, and Money.